This guide is tailored to business owners who either want to meet investors and raise funds or find sellers for their business. This guide helps you with a simple 12 point checklist to improve your business valuation.

Is your business set for profit or value? Modern day technology and fewer entry barriers in most industries have changed the business landscape around the world. Starting a business now is easier than ever before in human history. However, starting is just the first step. Convincing people to work for your business or product idea, convincing customers to buy your product and most importantly convincing investors to put money into your business are the most challenging aspects for a business owner. Once you have put a strong business foundation and created an interesting product people want to buy, you will need to raise funds to grow or sell your business. Convincing a buyer is as challenging as convincing investors to invest in your business. Investors and buyers want to invest their capital in a business which answers two key questions:

Is the business set to make profits in the short term?

Or Is it set up to deliver long term profits and value?

What investors want to see is the value in the long term. Today, investors or buyers want to put their money on value creation, not just on short term profits. They see profits as a byproduct of creating sustainable, long-term value to both customers and eventually the business owner.

When you prepare to sell your business, the ideal rule of thumb is to give yourself a two to three year head start. This is the phase when you optimize your business functions, eliminate inefficiencies, and shape the business for long-term success.

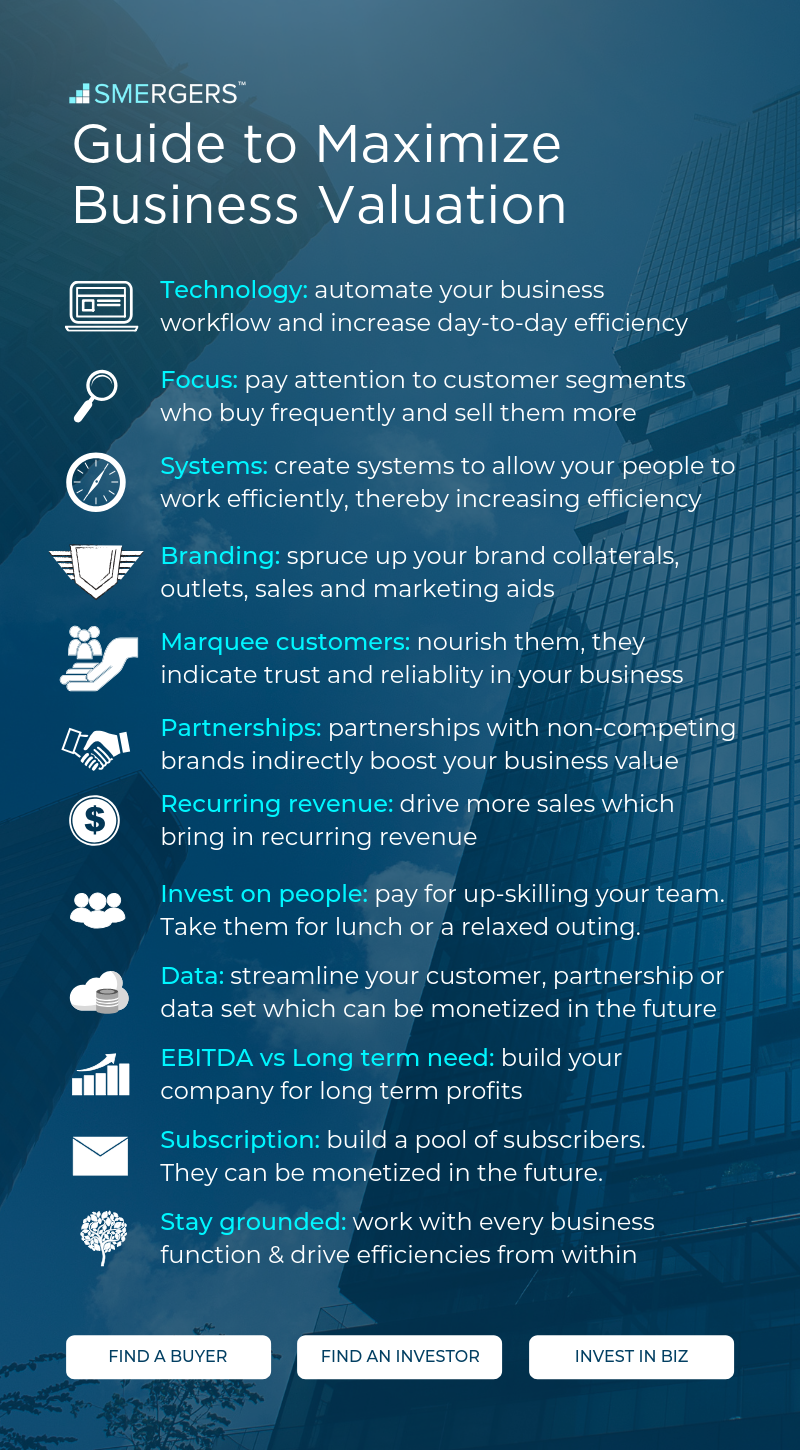

At SMERGERS we bring years of experience in successfully helping business owners raise funds and to sell their business. In the process we have learnt that there are 12 factors which play a major role in increasing the value of your business.

#1 Technology

If your business is a tech company, where customers use your tech product and pay for it, the value of your business is considerably higher than other businesses. If you don't sell tech products, maybe you use technology to conduct your business, like CRMs, HRMs, ERPs etc to automate some of your business functions. Investors and buyers love lean operable businesses. Because technology driven workflows and automated workflows mean you use fewer resources to make your product or service. Fewer resources mean fewer expenses each month.

Take away: If you haven't brought in efficient technologies to automate some of your business workflow, this is the time to do it. Not only you can bring your overheads down, you will also bring efficiency to your business.

#2 Focus

Now that you have decided to either raise funds or sell your business, what should be your focus? You might have several products or services and target a lot of customer segments. It is time to focus your business on what's bringing in more profits and develop solid capacity serving this segment.

Take away: Instead of saying to yourself "I want to sell this, this, because the more I sell the better value I bring to the business", we want you to pay more attention to products, services, and consumer segments who repeatedly pay for your product. Prepare strategies to sell them more. Not all businesses know who their best paying customers are. Achieving this will boost your business’ value.

#3 Systems

A business which runs on systems, not you the business owner, increases in value. If an investor or a buyer walks into your office and sees your sales rep on the phone talking to a customer handling all questions well, he maybe curious to know if you have this printed on a paper to help new sales reps. If your answer is 'no', you don’t have a system. What if a new sales rep is hired and how does he know what to say? If your answer is 'oh, we will make the new hire sit next to the sales rep' then you don't have a system at work. What does a customer do after purchasing your product or service? How do they request for support or a return? Is there a step by step guide shared with your customers to help them get the best out of your product or service? If no, then you don't have a system. Systems for operations, sales, support, and every business function brings discipline and control to your business. No matter who takes over a specific task, systems allow the newcomer to quickly understand the responsibilities of the role and get to attend customers.

Take away: Analyze each business function and start implementing the best systems to optimize each function. Buyers should get the confidence of running your business in a systematic way. And the investors would love to put their money into businesses which practice systematic service delivery all day long. Systems increase your business value.

#4 Branding

If retail or wholesale is part of your business, then look to spruce up and upgrade the facilities where possible. The same thing can apply to other branding aspects such as your sales and marketing aids, your website or mobile application. First impression and the freshness of experience are put under the light while raising funds or selling your business.

Take away: Start making a list of factors which badly need attention and uplifting. Once you have a list, then create a reasonable budget and get the right vendors or agencies to get the work done. The impact will be invaluable.

#5 Marquee Customers

Every good business accumulates marquee customer as it grows. If you picture your business strategy arrow pointing upwards, marquee customers are at the top of the spear of the arrow. They become your advocates and a long list of marquee customers indicate sustainable, reliable business. This is what investors and buyers value - trust.

Take away: Create a strategy to scan your list of frequent customers and put more effort to make them feel important with sharing new product or brand updates. Giving them the first taste of new launches before anyone. If you are already doing this, then great, put more efforts to add more customers to this marquee list.

#6 Strategic Partners

What is strategic partnerships? Strategic partnerships validate your business. They indirectly tell the investor or the buyer that 'we trust this business and we partner with them because we see long term value'. Another factor is that your partners can bring in aspects to your product or services which you cannot. Thereby increasing value to your customers. Strategic partners play a very big role in increasing your business value.

Take away: Assess your non-competing businesses and approach them for partnerships. The idea is to create a win-win situation for you and your partner business. If you do, this increases your business value immediately.

#7 Recurring Revenue

Ask yourself how much recurring revenue you generate each month, even if you don't sell your products or services. Recurring revenue is what drives investor’s money or the buyer's attention.

Take away: Do everything possible to increase recurring revenue streams from your customers. This significantly reduces the risk an investor or buyer would perceive in your business and drives up your business valuation.

#8 Invest in people

At the end of the day, people - your employees, sales reps, executives - help you run the business and bring in revenue. Invest in them on a professional level as well as a personal level. This is how startups to multi-billion dollar enterprises generate employee loyalty.

Take away: Start with helping your people learn new skills to help them do their job better. There are a ton of free and paid online courses from technical to business topics. Skilled workers bring more business. On a personal level, invest on short weekend trips or eat outs at fancy restaurants to help you create a sense of culture within your team. Happy employees make great companies.

#9 Data

Many a times we see companies writing billion dollar checks to buy small companies who don't generate any sizeable revenue. Instagram and WhatsApp are prime examples. Why? Because such companies might have access to a lot of data and a lot of users. Data is the modern-day oil.

Take away: Analyze the data your business generates from customers and partnerships. Assess how deep and wide your data sets are. Understand if any of them have the potential to be monetized legally in the near future. Quality and reliable data increases your business’ value.

#10 EBITDA vs Long term need

Assessing a business' EBITDA is a standard technique to ascertain business value. You might have read articles and opinion pieces about businesses who bring hundreds of millions of dollars of revenue, but their EBITDA remains a few million dollars. Strong EBITDA values drive your business price upwards, but this is only half the story. Investing or buying businesses because its EBITDA value is good means they are investing in and for the current market performance of the business. But not all businesses drive million dollar EBITDA very early on.

Take away: If your EBITDA is not strong, you need to focus on driving the long term need in your domain. Look at your industry and see if there's a need which is not addressed. Focus on that. Because if someone wants to buy or invest in your company, they will do so on the potential monetization of the long-term need and not only short term profits. Although you need to have profits. No one wants to invest or buy a business which makes no profits at all, right?

#11 Subscription and distribution

This is neatly connected with recurring revenue in one sense that you need customers to subscribe to your product or service and pay for it often. However, there are cases where subscribers not necessarily mean paid customers. Look at Huffington Post, they generate a lot of email subscribers who don't pay. But can be monetized in the future. Look at Evernote. During their initial days, they generated millions of subscriptions on their Freemium plan. Where people never paid money to use Evernote for years. But when the time was right, Evernote waited for people to depend on their product so much that they started charging them a handsome fee each month.

Take away: Try all within your will to generate more paid customers. But do not ignore the power of your free users. Turn them into subscribers and communicate with them often. They become your business' first target market for new products and services. Subscribers drive business value upwards.

#12 Stay grounded

Too many companies fail because business owners become “C.E.Os” too quickly. What we mean is that business owners need to stay in touch with every business function, every day. To understand ground realities and optimize business performance. You might be the Director or the Founder or the C.E.O, but you still need to know what's happening in sales, operations, technology, and all other functions.

Take away: Stay close to your customers, your business, its systems and drive optimization from within. This increases your business value and investors or buyers would put their money on someone who knows the business owner is doing on a daily basis.

Wouldn’t it be wonderful if you can find someone who has years of experience in business valuation, assessment, fundraising or business selling? Someone who can help you raise funds or sell your business? Put your worries to bed - write to us with your requirement at info@SMERGERS.com and we will connect with you find you the best solution.

Click here to understand how we help you to sell your business

Click here to understand how we help you to find investors for your business